FX Market Brief: May 2024

FINANCIAL MARKET ANALYSIS BY REGION

Euro-area

- The European Central Bank is widely estimated to start its monetary policy easing in June, with the market pricing-in a 94% chance of a 25-basis point rate cut, and at least two more by the end of the year.

- In March, we had one of the strongest Services CPI on record at 4% (where it stayed for 5 months) but in April, we finally saw the gauge tick lower to 3.8% which many policymakers welcomed, and markets took it almost as a sign of a guaranteed June cut. Many services firms have stated on ECB’s latest telephone survey that they expect to moderate their price rises, which should give the central bank further confidence to cut interest rates.

- Other key data such as wage growth should provide further tools for the ECB to start cutting. Wage growth data slowed towards the end of 2023 and should continue to do so this year as firms expect wage growth to feed less into prices than in 2023.

- The euro-area managed to exit recession as four of its biggest economies (Germany, France, Italy, and Spain) grew faster than expected by economists. First quarter GDP increased by 0.3% from the three previous months, the strongest pace in one and a half years.

| Date | Country | Economic Release/Event |

| 15- May-24 | Euro-Aggregate | GDP SA OoO |

| 15-May-24 | Euro-Aggregate | GDP SA YoY |

| 17-May-24 | Euro-Aggregate | CPI YoY |

| 17-May-24 | Euro-Aggregate | CPI MoM |

| 23-May-24 | Euro-Aggregate | HCOB Eurozone Manufacturing PMI |

| 29-May-24 | Euro-Aggregate | M3 Money Supply YoY |

| 31-May-24 | Euro-Aggregate | CPI MoM |

United Kingdom

- The Bank of England is scheduled to meet on the 9th of May, where no changes to its interest rates nor the quantitative tightening programme are expected. The market continues to point to the first cut in August, with a 100.03% chance of a 25-bps cut at the time of writing.

- The March meeting was interpreted by some investors as being dovish with hawkish officials Haskel and Mann switching their stance to “no change”, and the central bank stating that if it cut rates, it would still maintain policy restrictive enough to tighten the labour market, and contract wage growth and services inflation.

- CPI and Wage data came in higher than expected in April, with services inflation falling only to 6% YoY from the previous 6.1% in February. On the pay data, wages grew at a pace of 0.9% MoM in February.

- Confidence has increased across many sectors, and PMIs held up suggesting that the Q1 GDP print could recover strongly from last year’s recession. On the other hand, there was a softening of some labour data which hasn’t been paid much attention to, such as the unemployment rate ticking higher and a report on jobs showing weaker employment and wage growth.

| Date | Country | Economic Release |

| 09-May-24 | UK | Bank of England Bank Rate |

| 10-May-24 | UK | GDP OoO |

| 10-May-24 | UK | GDP YoY |

| 10-May-24 | UK | Industrial Production MoM |

| 14-May-24 | UK | Jobless Claims Change |

| 22-May-24 | UK | CPI YoY |

| 22-May-24 | UK | CPI MoM |

| 22-May-24 | UK | CPI Core YoY |

| 23-May-24 | UK | S&P Global UK Manufacturing PMI |

United States

- The Federal Reserve met at the May FOMC meeting and Fed Chair Jerome Powell pushed back on further tightening and flagged the importance of the US Labor market report to policymakers.

- Jobs data released on the 3rd of May came in softer, with payrolls coming in way lower than expected at 175,000 versus est. 240,000. This drastic change in the labor market report led traders to pull forward their interest rate cut bets to September, from November. It is important to note that Powell suggested at the FOMC meeting that the central bank would be “prepared to respond to unexpected weakening in the labor market”, but obviously other factors enter the equation.

- The focus now shifts to the US core CPI print on the 15th of May which in combination with a still-strong jobs report and sticky inflation will continue to support the “higher for longer” stance and continue to support the US Dollar.

| Date | Country | Economic Release |

| 10-May-24 | US | U. of Mich. Sentiment |

| 14-May-24 | US | PPI Final Demand MoM |

| 15-May-24 | US | CPI MoM |

| 15-May-24 | US | CPI YoY |

| 15-May-24 | US | Retail Sales Advance MoM |

| 23-May-24 | US | S&P Global US Manufacturing PMI |

| 24-May-24 | US | Durable Goods Orders |

| 24-May-24 | US | U. of Mich. Sentiment |

| 16-April-24 | US | Conf. Board Consumer Confidence |

| 18-April-24 | US | GDP Annualized OoO |

CURRENCY PAIRS ANALYSIS

EUR/USD

- The outlook for the Euro continues to be daunting. We were trading near 1.09 at the beginning of April and dropped significantly to test the 1.06 level, and many suggest the pair should be even lower. It is true, the Euro has been resilient against a stronger greenback on the back of strong US Data and a dovish ECB, but this is mainly due to the market not so long ago expecting at least a cut by the Fed in the first half of 2024, which no longer verifies and that is why we broke through 1.07 – the market view on the Fed finally changed.

- We continue to forecast a weaker euro, especially as the timing of rate cuts has widened between both central banks, as political tensions in the Middle East remain and ultimately affect oil prices and global risk sentiment.

- Support: (S1- Key) 1.06, ( S2 – Key Support from Q123) 1.0520 , (S3) 1.0450

- Resistance: ( R1) 1.08 , (R2) 1.10

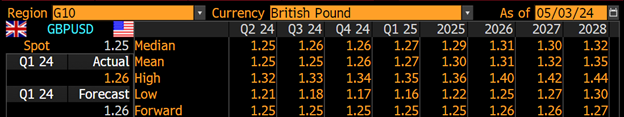

GBP/USD

- There is little in terms of what the Bank of England will be able to deliver next week for Sterling and the only thing that should matter to GBP is any guidance on future rate cuts, and if more members of the central bank start to turn more dovish. Any dovish moves, either via speeches or via the minutes, should drive sterling lower but not significantly. We still believe this continues to be a US Dollar story, and unlike the Euro, bets for rate cuts are slightly less, with markets still not pricing two full rate cuts by the end of the year, which should help sterling not to depreciate as much as the euro.

- Support: (S1) 1.23, (S2) 1.22, (S3) 1.20

- Resistance: (R1) 1.26, (R2) 1.2705, (R3) 1.280

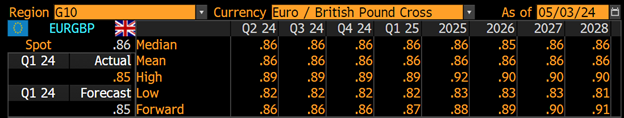

EUR/GBP

- The cross continues to be stuck in the 0.85-0.86 range and consolidates around 0.8550. We expect some downside on the pair especially as the ECB looks set to start cutting interest rates from June whilst the BOE looks less firm on its easing policy. All eyes will be on the BOE’s 9th of May monetary policy announcement and minutes, where policymakers are widely expected to hold interest rates at 5.25% for the sixth consecutive time.

- Investors now expect three rate cuts by the ECB, especially as ECB’s Governor Stournaras clearly stated, “We now consider three cuts in 2024 as the more likely scenario.”

- Support: (S1- Key) 0.8500, (S2) 0.8495

- Resistance: (R1) 0.8645, (R2- Key) 0.87

For an analysis of your exposures and currencies mentioned in this FX Markets Update, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.