Finance Digest – 5 FX Metrics Your Business Should Be Tracking

![]() Businesses dealing internationally in multiple currencies are often met with the task of creating their own FX risk management strategy in order to limit losses to their bottom line from currency fluctuations. As such, the FX brokerage industry has emerged and thrived for the past 2+ decades, with many of them helping corporations develop and execute customized solutions. What those businesses often end up with is a relationship with an account manager that calls them when the market moves in their favor with a couple of hedging tools to pick from to add coverage over a range of dates. While this style of FX hedging may not seem terrible in low-volatility environments, the bigger picture is not considered in these instances. While large unfavorable currency moves would make that hedge look good independently, the fact that it likely does not represent 100% of your yearly FX cash flow means your average rate over your budgeted period has also moved against you.

Businesses dealing internationally in multiple currencies are often met with the task of creating their own FX risk management strategy in order to limit losses to their bottom line from currency fluctuations. As such, the FX brokerage industry has emerged and thrived for the past 2+ decades, with many of them helping corporations develop and execute customized solutions. What those businesses often end up with is a relationship with an account manager that calls them when the market moves in their favor with a couple of hedging tools to pick from to add coverage over a range of dates. While this style of FX hedging may not seem terrible in low-volatility environments, the bigger picture is not considered in these instances. While large unfavorable currency moves would make that hedge look good independently, the fact that it likely does not represent 100% of your yearly FX cash flow means your average rate over your budgeted period has also moved against you.

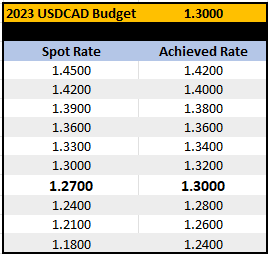

To complement this, there are a number of data sets that are very important to keep in mind when executing your own FX strategies. Most businesses with recurring, forecastable cash flows in specific currencies often use a budgeted exchange rate for a specific period – a rate to benchmark in the calculation of profit margins. Instead of thinking that it is a good idea to hedge simply because the market moved in your favor, consider hedging because of what it means for your overall portfolio. Also, consider how much closer it gets you to achieving your budgeted rate for the year. Below are some examples of specific metrics to keep in mind:

- Total Monthly/Quarterly/Yearly Exposures

- Hedge Ratios

- Rate Required to Achieve Budget

- P&L Scenario Analysis

- MTM Scenario Analysis

STRATEGIC FX METRICS

Total Monthly/Quarterly/Yearly Exposures

While some businesses do not have the luxury of being able to quantify their exposures, those with steady recurring FX cash flows that are able to be forecasted at a reasonable rate, should always keep this in mind throughout the year. Looking at past actuals vs forecasts is a very good way of assessing the margin for error.

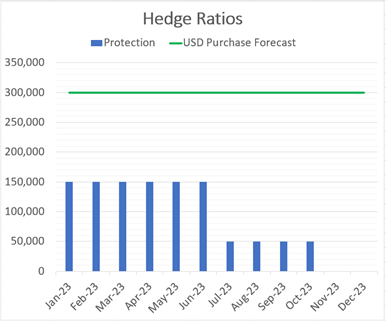

Hedge Ratios

Once you have quantified your exposures and margin for error, you can now determine your preferred hedge ratios (% hedged vs forecasts). The lower your margin for error, the higher the hedge ratio you have the ability to use. The amount of experienced volatility in your average rate for the year will decrease, as your hedge ratio increases. Most businesses will model their hedge ratios on their profit margins. For example, a grain marketer with 3-4% profit margins will hedge as close to 100% as possible. While a manufacturer with 20+% profit margins, will allow themselves more flexibility with high hedge ratios in the short term, say for the first 3 months or so, but lower hedge ratios farther out in time. Once you quantify your preferred hedge ratios, you can plug in the hedges you already have on the books and by using your forecasts, identify room for future hedges.

Rate Required to Achieve Budget

The first two metrics in this section are very common among businesses with FX exposures. Now we will get into the less common metrics that should be quantified to be able to gauge just how well the current strategy is working. The first of which, being the rate you require to achieve for the rest of the year. This is done by taking the trades you have already delivered, the hedges you currently have on the books and then calculating your average rate. From there, they can calculate the rate they need to achieve for the rest of the year by using their forecasted remaining exposure. Remember, it is not about beating your budget rate in every single hedge and/or spot deal – it is about your average rate for the year coming in at or better than your budget rate.

P&L Scenario Analysis

Once you calculate the rate you need to achieve budget, it is also important to understand your P&L based on coming in higher or lower than that rate. No one can predict FX markets with 100% accuracy, and even if someone could they’d be sitting on a beach right now with a margarita in their hand, counting their money and taking their secrets to the grave. For us regular people who need to accept that future FX volatility is uncertain, being able to quantify yearly FX P&L vs. budget in a myriad of scenarios is instrumental in making quick, easy decisions around executing hedges. For example, a US business that purchases EUR with a 2022 budget rate of 1.15 should understand the implications of hedging at parity (1.00) for the rest of the year from an average rate and P&L standpoint.

MTM Scenario Analysis

Depending on the financial state of a business, FX brokers will often grant credit facilities that allow hedging without posting any upfront margin. That said, in most cases at least, stipulations within the credit terms allow these brokers to margin call the client if the cumulative negative value of their hedges exceeds a specific threshold. Banks will do something similar with an independent FX line. However, exceeding their threshold will automatically tie up a portion of their operating line. Understanding not only your current mark-to-market, but the approximate rate (since forward points, implied volatility, time value are dynamic) that the currency pair needs to hit before being margin called, is extremely important to not only be prepared from a cash flow perspective, but to be proactive and deploy strategies to counter the negative MTM before the rate gets there.

WHY IT MATTERS

Each business is different and there is no “perfect” way to handle your FX risk. Nonetheless, understanding the data sets that are available to you and how to use them to your advantage will go a very long way in ensuring you always have a beat on how your current strategy is meeting your overall goals. After all, FX management is likely a small part of your role, so if this allows you to make faster, more efficient decisions, then you can focus on other more pressing issues with your valuable time.