FX Market Brief: February 2024

FINANCIAL MARKET ANALYSIS BY REGION

Euro-area – Not the first, but surely not the last…

- The ECB kept interest rates unchanged at the January meeting, but it suggested that it is open for interest-rate reductions this year. President Christine Lagarde, however, did not show much to the market, as she refused to give any specific time for a rate cut, which it translated into not having one any time soon and made the June meeting more feasible. The market has priced in a 50% chance of a 25-bps rate cut in April, and 100% chance of a 25-bps rate cut at the June meeting followed by at least one rate at every meeting until the end of the year.

- As stated in previous commentaries, the Federal Reserve sets the tone for the global monetary policy and we fear that until the Fed cuts (which may not be as soon as expected given last week’s data), the ECB won’t risk being the first to ease.

- Inflation should start to come off in the euro-area in the upcoming months creating momentum for a greenlight for rate cuts. Inflation gauges came in line with the estimations for January, and growth YoY remained at 0.1%, except for Quarter-on-Quarter change where the economy shrunk a small 0.1%. This data will help the hawks delay any rate cuts – the economy is not collapsing, and the Governing Council can afford to wait for a more consistent inflation trend.

| Date | Country | Economic Release |

| 14- Feb-24 | Euro-Aggregate | GDP QoQ & YoY |

| 22-Feb-24 | Euro-Aggregate | Core CPI YoY and MoM for Jan. (Final) |

| 22-Feb-24 | Euro-Aggregate | Headline CPI YoY and MoM for Jan. (Final) |

| 22-Feb-24 | Euro-Aggregate | Eurozone PMI Data (Manufacturing, Services and Composite) |

United Kingdom – As you were, for the time being….

- The Bank of England’s first policy meeting of the year came and went with few fireworks. Whilst keeping monetary policy unchanged, members of the MPC confirmed that they are not willing to keep interest rates at restrictive levels for more time than is required. With the BoE unlikely to shift rates before the Fed does, a June cut remains the most likely outcome for the central bank.

- The interest rate outlook became even more cloudy with the release of the January CPI data coming in higher than expected, tempering any chance of an early pivot on Threadneedle Street. Headline CPI (YoY) rose to +4.0% against market estimates of +3.8%, and UK Core CPI (YoY) advanced to +5.1% versus +4.9% expectations.

- The key message from the BoE remains that it is “premature” to talk about rates cuts until inflationary pressures start to wane in the coming months. The constant uncertainty over the timing of central bank moves has kept the pound rangebound against its peers.

| Date | Country | Economic Release |

| 13-Feb-24 | UK | Jobless claims and average earnings for Jan |

| 17-Jan-24 | UK | CPI and PPI for Jan |

| 19-Jan-24 | UK | Quarterly GDP for Q4 |

| 24-Jan-24 | UK | Services, Manufacturing & Composite PMI for Feb |

United States – Just as things were going in the right direction… Boom!

- Both the statement for the FOMC meeting released at the end of January, and Fed’s Chair Jerome Powell speech, strongly pushed back on any imminent rate cuts, stating that the committee needs further evidence that inflation is heading towards the 2% level before looking to cut interest rates.

- Powell and the committee saw the March cut as unlikely but not off the table, however, last week’s Non-Farm Payroll data came in as a surprise at 353,000 jobs added in January, driving the market to evaporate cut bets for the next meeting and moving them to May (currently a 70% chance of a 25-bps cut).

- As Powell stated in his interview with the CBS program “60 minutes”, recorded on the 1st of February – before the explosive Non-Farm Payrolls – an earlier cut would be conceivable if the committee “saw weakness in the labour market or if we saw inflation really persuasively coming down”. Well, it looks like that will not be the case for now.

- In terms of growth, recent data suggested that the US could achieve a soft landing as we saw fourth-quarter GDP rising at annual pace of 3.3%. On the inflation side, we had a surprisingly strong CPI print for December, which just demonstrates that the road to the 2% target will be a bumpy one and it can prove to be difficult.

- The Federal Reserve is now expected to be data-dependent on any further interest rate decisions, especially as we had mixed-data across the board.

| Date | Country | Economic Release |

| 13-Feb-24 | US | Core CPI YoY and MoM for Jan. |

| 13-Feb-24 | US | Headline CPI YoY and MoM for Jan. |

| 15-Feb-24 | US | Empire Manufacturing |

| 15-Feb-24 | US | Retail Sales Advance MoM for Jan. |

| 15-Feb-24 | US | Industrial Production MoM for Jan. |

| 16-Feb-24 | US | U. of Michigan Sentiment |

| 21-Feb-24 | US | FOMC Meeting minutes |

| 22-Feb-24 | US | S&P Global US PMIs |

| 28-Feb-24 | US | GDP Annualized QoQ |

| 29-Feb-24 | US | Personal Income & Spending for Jan. |

CURRENCY PAIRS ANALYSIS

EUR/USD

- Since the 23rd of January we have been trading out of the bullish range that started almost 4 months ago, but that strong Non-Farm Payroll on Friday really took us off the rails and brought a lot of Euro-bears to play.

- Impressive ISM Data supported the greenback, but the pair got stopped at 1.0724 (Dec. low). We bounced back from there on China stimulus news, but the market is heading towards that same level again.

- The pair’s path is highly dependent on data and any changes on the guidance for monetary policy from the Fed or the ECB.

- Resistance is seen at 1.0820, followed by 1.0903 (where the 50 DMA lies).

- Support seen at 1.0724, followed by key support at 1.0660 (November’s pullback).

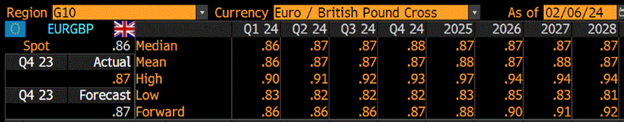

EUR/GBP

- • Interest rate differentials have supported the pair to trade lower, specially as the BOE is seen holding interest rates higher for longer compared to the ECB. We broke a key support at 0.8550 at the back end of January and tested lower at 0.8515 several times but got rejected.

• We have now been trading in the 0.8520-0.8570 for the past week and key support remains at 0.8500.

• First resistance is seen at 0.86, followed by key resistance at 0.87.

• First and key support remain at the 0.85 level.

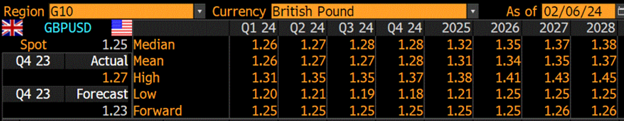

GBP/USD

- GBP/USD had been trading comfortably within a 1.26-1.28 range since mid-December, but that all changed with the release of the above consensus January labor market report from the US and a somewhat hawkish tone from Fed Chair Jerome Powell just a few days later.

- Cable continues to be influenced by interest rate differentials, with the pair rallying on the higher-than-expected UK inflation report to test the top of the range at the start of 2024. The NFP report at the start of February triggered a sell off to test the lower boundary of the range.

- Resistance is seen at 1.2780 ahead of 1.2830.

- Support comes in at 1.2520, ahead of the psychological 1.25, where a breach opens the way to test 1.22.

USD/CAD

- Interest Rate Dynamics: USD’s 0.63% pre-2018 rate lead shifted post-2020 cuts to 0.125% USD vs. 0.25% CAD, affecting USD/CAD parity and favoring CAD temporarily.

- From a 15 billion USD deficit, Canada moved to a 4 billion USD surplus by Q2 2022, driven by a 1200% spike in oil prices over the same period, moving USD/CAD to a low of 1.20 before stabilizing in the 1.30s as conditions normalized.

- Post-Q2 2022, rate hikes introduced volatility, with USD/CAD fluctuating between 1.20-1.30. The pair is now near a multi-year resistance at 1.3875, with an upward trend towards 1.36, pending rate cut impacts and Fed policy signals.

USD/MXN

- The USD/MXN’s relationship with the VIX shows a variable correlation, peaking at nearly 0.50 during financial crises, which underlines the pair’s increased correlation to volatility in times of distress.

- In 2020, USD/MXN surged to 25, driving a swing in Mexico’s current account from a -2% GDP deficit to a 2% surplus, attracting foreign capital and strengthening the peso to a rate of 19.

- The peso’s enduring strength, despite widening current account deficits to -0.6% and -1.2% of GDP in subsequent years, is partly due to the interest rate gap with the USD, initially at 5.88% in the peso’s favor, narrowing to 3.6%, and then widening again, facilitating a continued carry trade appeal.

- Technically, the peso is close to a significant support at 16.71, unseen since 2016, hinting at a possible 2.5% depreciation, dependent on breaking through a nearer trend support at 16.80.

USD/JPY

- For years Japan has been the poster child of running a current account surplus, such surplus’ put pressure on a country’s currency to appreciate and through the global financial crisis of ’08 to late 2012 it did, with USDJPY hitting all-time lows of 75.90 and the current account moving into a deficit. Later exchange rate moves driven by interest rates returned Japan’s surplus.

- Through the same period JPY held a 0.00% interest rate while USD held a .13%. In late 2013 and early 2014 USD rates bumped to .38% which sent USDJPY higher off its lows. Current account surpluses weakened the pair until the start of the USD rally in February of 2021 on expectations of rate hikes. Currently, USD strength drives the pair while an interest rate differential in favor of USD and the current account surplus of Japan indicates future fundamental weakness.

- USDJPY volatility is currently being driven by USD strength. As such, the exchange rate is highly correlated to DXY which was recently rejected by the 104.597 resistance level though on comparatively lower volume than past rejections. Near term trading sees DXY moving between 103.432 and 104.597 with a slight trend bias toward retesting 104.597. This is a circumstance where near-term technical do not agree with long-term fundamentals.

USD/CNY

- China has maintained a surplus in its current account since 1998 except for a recession in 2018 and another in 2020. The USDCNY rate was pegged to USD until 2005, when the peg broke, the renminbi strengthened and the surplus increased. Post-2005 China pegged the USDCNY rate to a basket of currencies to ensure that the renminbi stays cheap comparatively for the purpose of encouraging international trade. Generally, the significant surplus that exists today will have the effect of strengthening the renminbi though active reserve management can mitigate the effects. The USDCNY interest rate differential would also have the effect of strengthening CNY relative to USD and weakening the rate.

- Technical analysis holds less merit with currencies that are not free floated. Though current trends have USDCNY consolidating toward 7.30 through April ’24.

For an analysis of your exposures and currencies mentioned in this FX Markets Update, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.