FX Market Brief: March 2024

FINANCIAL MARKET ANALYSIS BY REGION

Euro-area

- The European Central Bank is preparing for a rate cut, with the market currently pricing in the first move of 25 basis points to be in June. Various gauges have suggested that inflation is coming down towards the 2% goal, activity has deteriorated significantly, and that credit availability is at one of the lowest levels since the euro crisis.

- The key question now is if the ECB breaks before the Federal Reserve does. Unless the economy were to collapse, the central bank may still need proof that the wage growth is decelerating, and that inflation continues do decrease consistently.

- Tougher lending conditions will continue to pose a great risk for the euro-area economy throughout this month, and it will be key to evaluate key economic data to check on the economic and fiscal resilience of the euro area that would avoid a cut at or before June time.

| Date | Country | Economic Release/Event |

| 07- Mar-24 | Euro-Aggregate | ECB Main Refinancing Rate |

| 07-Mar-24 | Euro-Aggregate | ECB Marginal Lending Facility |

| 07-Mar-24 | Euro-Aggregate | ECB Deposit Facility Rate |

| 08-Mar-24 | Euro-Aggregate | GDP SA QoQ |

| 08-Mar-24 | Euro-Aggregate | GDP SA YoY |

| 18-Mar-24 | Euro-Aggregate | CPI YoY |

| 18-Mar-24 | Euro-Aggregate | CPI MoM |

| 18-Mar-24 | Euro-Aggregate | CPI Core YoY |

| 21-Mar-24 | Euro-Aggregate | HCOB Eurozone Manufacturing PMI |

| 21-Mar-24 | Euro-Aggregate | HCOB Eurozone Services PMI |

| 21-Mar-24 | Euro-Aggregate | HCOB Eurozone Composite PMI |

| 28-Mar-24 | Euro-Aggregate | M3 Money Supply YoY |

United Kingdom

- We have learned very little from the Bank of England and MPC policymakers in the past month as we remain data dependent, searching for clues on the timing of any potential rate cuts. Sticky inflation remains a headache for rate setters who are unlikely to cut before the Federal Reserve, and with officials on the FOMC pushing back on the timing of their first reduction, the August MPC meeting is currently priced in for the first reduction.

- The UK economy entered a technical recession for the second half of last year, with GDP shrinking 0.1% in December and by 0.3% in the fourth quarter. Forward-looking data also remains fragile with recent PMI data showing a mixed result with the services and composite components showing gains, whilst construction remains subdued and below the 50 level, which separates growth from contraction.

- Markets continue to data watch, with the March CPI report as the main attraction, which comes a day ahead of the March MPC meeting where a further pause is fully expected.

| Date | Country | Economic Release |

| 12-Mar-24 | UK | Jobless claims change |

| 12-Mar-24 | UK | ILO Unemployment Rate 3Mths |

| 12-Mar-24 | UK | Claimant Court Rate |

| 13-Mar-24 | UK | Industrial Production MoM |

| 13-Mar-24 | UK | Manufacturing Production MoM |

| 20-Mar-24 | UK | CPI YoY |

| 20-Mar-24 | UK | CPI MoM |

| 20-Mar-24 | UK | CPI Core YoY |

| 21-Mar-24 | UK | S&P Global UK Manufacturing PMI |

| 21-Mar-24 | UK | Bank of England Bank Rate |

| 22-Mar-24 | UK | Retail Sales Inc Auto Fuel MoM |

| 22-Mar-24 | UK | Retail Sales Inc Auto Fuel YoY |

| 28-Mar-24 | UK | GDP QoQ |

| 28-Mar-24 | UK | GDP YoY |

United States

- On the other side of the pond, the story is different. Fourth quarter GDP growth beat economists’ expectation, positing a rise of 3.3% YoY, boosting sentiment that the Fed will deliver a soft landing, but data released throughout February suggests this will be a bumpy ride.

- Annual Core PCE Inflation dropped by 2.8% in January (vs. 2.9% prior) but the monthly supercore PCE inflation ticked higher to 0.6% from previous 0.3%. Personal Income growth came in as a surprise, increasing by 1% in January, but mainly due to temporary or one-off factors, such as the adjustment for social security recipients. The manufacturing sector continues to show signs of a slowdown as well as new orders, inventories, and employment.

- Fed policymakers have been given a lot of mixed data at the beginning of this year, but one thing is clear – the US economy remains resilient. In a recent interview, Fed’s Raphael Bostic stated that he only expects an interest rate cut by the third quarter, and that he does not anticipate them to be “back-to-back”. Bostic joins the rest of his colleagues that have also stated in recent weeks that there is no rush to cut interest rates.

| Date | Country | Economic Release |

| 07-Mar-24 | US | Change in Nonfarm Payrolls |

| 08-Mar-24 | US | CPI MoM |

| 12-Mar-24 | US | CPI YoY |

| 12-Mar-24 | US | MBA Mortgage Applications |

| 13-Mar-24 | US | Initial Jobless Claims |

| 14-Mar-24 | US | Retail Sales Advance MoM |

| 14-Mar-24 | US | U. of Mich. Sentiment |

| 15-Mar-24 | US | MBA Mortgage Applications |

| 20-Mar-24 | US | FOMC Rate Decision (Upper Bound) |

| 21-Mar-24 | US | Initial Jobless Claims |

| 21-Mar-24 | US | S&P Global US Manufacturing PMI |

| 26-Mar-24 | US | Durable Goods Orders |

| 26-Mar-24 | US | Conf. Board Consumer Confidence |

| 27-Mar-24 | US | MBA Mortgage Applications |

| 28-Mar-24 | US | Initial Jobless Claims |

| 28-Mar-24 | US | GDP Annualized QoQ |

| 28-Mar-24 | US | U. of Mich. Sentiment |

CURRENCY PAIRS ANALYSIS

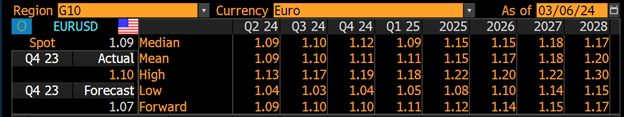

EUR/USD

- February’s range has been 1.0695-1.0898 and we are currently trading at 1.0855. It is hard to find a direction on the pair for now, but the 1.09 level looks under pressure as we estimate upcoming US data to be weaker than expected, which could trigger a significant US Dollar sale and risk-on activity. Apart from this, the ECB is expected to meet on the 7th of March where no major surprises are expected, but any comments that may shake the June bets will get the pair moving.

- First Support: 1.0790; Key Support: 1.0655

- First Resistance: 1.0885; Key Resistance: 1.1010

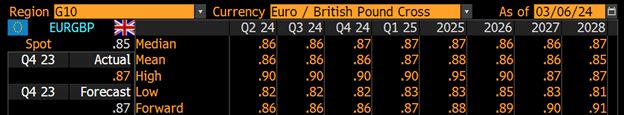

EUR/GBP

- The pair has been range bound for this past month, and it is currently trading at 0.8550. Hot Eurozone inflation has increased uncertainty over the ECB’s timing of rate cuts, but we still expect the BOE to cut at an even later stage with the UK having the highest inflation among its G-7 peers. This should continue to support the pound sterling in the upcoming months but unless the ECB or BoE changes its stance, we should remain on the levels we have been at these past two months.

- First Support: 0.8500; Key Support: 0.8495

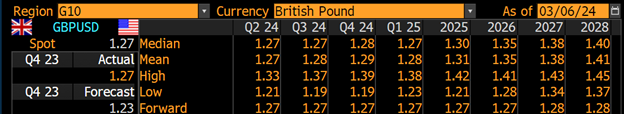

GBP/USD

- As per the chart detailed below, GBPUSD remains broadly within its recent trading range but has enjoyed a brief rally to trade above 1.27. This move was largely in line with recent US dollar weakness rather than sterling strength following a bumper labor market from the US.

- The February US Non-farm Payroll report will be closely monitored, with markets forecasting a lower print of circa 200k and more in line with the recent average. A significant deviation from here may push cable outside of its recent 1.26 to 1.28 trading range.

- First Support: 1.2635; Key Support: 1.2500

- First Resistance: 1.2700; Key Resistance: 1.2830

USD/CAD

- CAD Correlation to Oil: CADUSD has a high correlation to oil that fluctuates between positive and negative depending on USD specific volatility. For the past 6 months, USDCAD has had a high positive spatial correlation with oil leading by a month on average.

- USDCAD and OIL/USD share an inverse USD relationship. Relatively low value fluctuation in USD over the past six months has allowed the CAD-OIL correlation to remain strong. CAD’s lagged correlation to oil (due to exports) lends itself to forecasting.

USD/MXN

- Technical Levels and Depreciation Potential: Per our forecast last month, the Peso has continued to strengthen. There exists a near term upward trending support that Peso is expected to break at 16.86. Breaking through 16.67, the next low is an Oct. 2025 level at 16.67.

- Balance of Payments: Peso current account surplus soared to almost 12.6 million USD in December 2023, driving continued Peso strength. Additionally, at the current interest differential. The carry remains one of the most attractive in FX.

USD/JPY

- Technical Analysis: Across the board USD volatility has been flat for February, as such USDJPY changes are driven by JPY weakness.

- Currency Yield Curve Controls: The Bank of Japan has practiced currency yield curve controls since September 2016 to keep the 10-year Japanese Government Bond (JGB) yield at around zero percent. The controls were designed to keep the inflation rate at a steady 2% – a level that can promote growth without compromising currency stability. 2024 sees Japan relaxing its yield curve management which has promoted a steady slide in the value of the Yen.

- Combined Factors: In this case fundamental and technical indicators coincide. Outside of unusual dollar rate cut surprises – USDJPY is expected to weaken further.

USD/CNY

- Technical Analysis: USDCNY remains little changed for February and the outlook for March remains the same.

For an analysis of your exposures and currencies mentioned in this FX Markets Update, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.