FX Markets Update: June 2023

SUMMARY

- Global inflation remains stubbornly high.

- The Bank of England remains on course to deliver additional interest rate hikes.

- The European Central Bank is on track for two more rate hikes, in July and September.

- Euro-area core inflation remains one of the biggest issues for the ECB.

- The US paused at its June policy meeting, with markets expecting two additional 0.25% increases.

- Global economy shows resilience, however softer China growth is weighing on global activity.

ANALYSIS

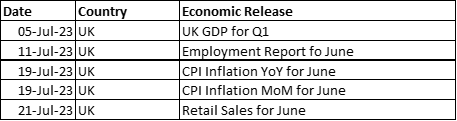

United Kingdom

The Bank of England delivered a surprise 0.50% interest rate increase at its June policy meeting, taking the benchmark rate to a 15-year high at 5%. The move came in response to persistent inflation in the UK, with Core inflation increasing from 6.8% YoY in April to 7.1% YoY in May, above consensus expectations. The headline inflation rate remained unchanged in May at 8.7%, considerably above the central bank’s target rate, prompting MPC members to vote 7-2 in favour of a 50bp hike. Analysts’ views on the outlook for UK interest rates remain mixed, with the terminal rate seen between 5.5% and 6%. Much will depend on the outlook for inflation, which remains extremely persistent. Household energy bills are expected to strip a little under 2% from the annual CPI rate by the end of the year, as the price cap falls to reflect the recent drop in wholesale prices. However, headline inflation is still expected to end the year above 5%, and not drop towards the BoE 2% until 2025.

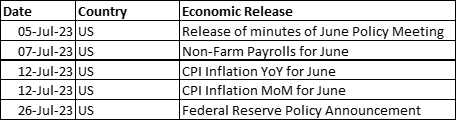

In contrast to the BoE, the US Federal Reserve chose to “skip” a rate increase in June, the first pause following 10 consecutive hikes. Whilst inflation continues to run well above target, there are signs that it may start to moderate. The Federal Reserve “dot plot” continues to suggest that the central bank will deliver two further increases of 0.25% this year. The housing market remains resilient and job growth is averaging around 200-300k per month, consistent with an unemployment rate of 3.7%.

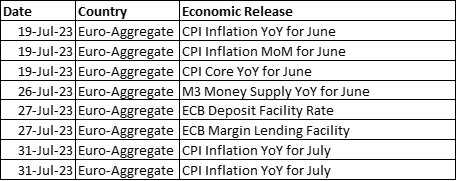

Europe

In Europe, the European Central Bank hiked interest rates by 25 basis points at the Governing Council’s meeting in June and quickly indicated a further one in July providing the markets with no hint of when it was going to stop. Resilient inflation under restrictive borrowing conditions seemed to be the main topic throughout the month of June and one of the main worries of ECB policy makers this past month.

Headline inflation eased in the month of June to 5.5% (vs. 5.6% est.), from the previous 6%, reaching the lowest level before the war in Ukraine started. Energy and food prices remained “stable”, with no sharp gains in the month of June which helped trim around 0.6% of the headline inflation in June. On the other hand, core inflation, which does not include energy and food prices, has shown to be sticky and not an easy one to get under control in the euro-area, increasing from the prior 5.3% to 5.4% (vs. 5.5% est.).

Yes, Eurozone Core inflation has been the “killjoy” of the party, especially as energy and food prices are finally on a consistent downward trend and bringing the headline number lower. It is safe to say that this supports the case to raise interest rates next month.

Several inflation data prints across the 20 members of the euro-area were released last week and Spanish inflation was the one to shine out of all the others, moving to 1.9%, from the previous 3.2%, below the ECB’s medium-term target of 2%. Other countries such as Germany, France, Italy, and the Netherlands stayed well above the wished goal.

German YoY CPI inflation rose to 6.8% mainly driven by a super-cheap monthly public transport ticket introduced by the German government from June to August last year to help German citizens to cope with surging energy bills. This has helped pick up service inflation which in turn contributes to core inflation. While inflation initially was caused by commodity prices due to the war in Ukraine, now the concerns float around strong demand for services and accelerating wages by firms across all of Europe to make up for less disposable income.

We are now expecting the ECB to hike interest rates in July by 25 basis points, followed by another similar-sized hike in September, leading to a 4% terminal rate. ECB officials have stated that once the benchmark interest rate peaks, it will likely stay there until price pressures are under control, which leads us to not expect any cut until 2024.

CURRENCY PAIRS: What happened and what is next?

GBP/USD

GBPUSD has been within an uptrend since the disastrous mini budget at the end of last year and has benefitted from the “cost of carry” as the UK continued to raise interest rates. After rallying to the 1.24 area in Q1, cable spent some time consolidating around this level before trading through 1.26 in June as the US Federal Reserve paused its hiking cycle. The interest rate differential between the UK and US continues to favor sterling, however investors remain nervous of the outlook for the UK as consumers face higher inflation amid a cost-of-living crisis. These concerns continue to cap any rally in GBPUSD with 1.2850 offering considerable resistance. This can further be witnessed following the BoE decision to hike by 0.5% on 22 Jun when GBPUSD initially rallied through 1.28, only to drop back within its recent trading range to consolidate in the mid 1.27’s. The failure to breach and hold above 1.28 has again opened the downside in GBPUSD with a pullback below 1.2550 required to signify a break in the recent trend. In the short-term cable is likely to consolidate around 1.27, supported by yield differentials.

Source: Bloomberg

Whilst sterling has been the best performing G10 currency against the US dollar this year, it has come from a low base following the mini-budget related crash in September last year. With the Federal Reserve seemingly coming to the end of their interest rate hiking cycle and further hikes in the pipeline from the BoE, many analysts are bullish on the pound suggesting a return to 1.30. However, the uncertainty caused by higher interest rates of UK households, in the form of higher mortgage payments, coupled with ongoing concerns over cost-of-living crisis has so far kept a cap on cable. This uncertainty can be seen in the latest FX Forecasts published below.

Source: Bloomberg

With the focus remaining on the outlook for inflation and interest rates, markets will be paying close attention to upcoming economic data for further clues on the path for GBPUSD.

EUR/USD

Unlike GBPUSD, the euro-dollar is only 1.60% up this year and struggles to maintain a consistent performance against the greenback. At the beginning of May this year, we touched 1.1062, a combination of Fed Doves and ECB Hawks, markets started betting on a policy pivot by the Federal Reserve, and uncomfortable inflation data in Europe. Well, as we have seen, things did not turn out alright for the euro-bulls. We fell through the 1.10 level as growing concerns on the debt ceiling started to build up and turned investor sentiment back to the US dollar and by the end of May we were at 1.0689.

Things really saw a turn after a deal was announced on the debt ceiling of the US, which was ultimately lifted, leading investors to put on their ‘risk-on’ boots and buy national equites and foreign assets, leading to an appreciation in euro and sterling. This was then followed by a pause by the Federal Reserve on the 14th of June, the day after the ECB continued its hiking campaign, delivering another 25 basis points increase. This took the euro off the lows to surge to the 1.0986 level, aiming at the 1.10 level once again.

At the end of the month the euro was lower at 1.0840 as bets on another 2 hikes by the Federal Reserve are now back on the table after a few policy makers came out to the public as more hawkish than markets were expecting, stressing the need to do more to tame inflation. Data released on the final day of the month showed that US inflation cooled, and that spending has stagnated, with Powell’s favourite inflation gauge (PCE Index) hitting a 10-month low. EUR is now making its way through the 1.09 level again and a hawkish ECB combined with alarming core inflation in Europe should support the euro in the month of July.

Source: Bloomberg

The outlook for EURUSD remains uncertain but with the ECB set to increase interest rates further over the summer and the Fed signaling two more increases it is likely that the pair will remain within its recent range in the short term. Should the ECB prove to be more hawkish, there remains the possibility for the single currency to gain, but the high 1.09’s and psychological 1.10 will remain stubborn resistance. A breach of this area opens the possibility of a test of the 1.12 area. However, risks to the downside remain in place should US data continue to show resilience, with a breach of the recent 1.0689 low bring support at 1.0550 back in to play.

Source: Bloomberg

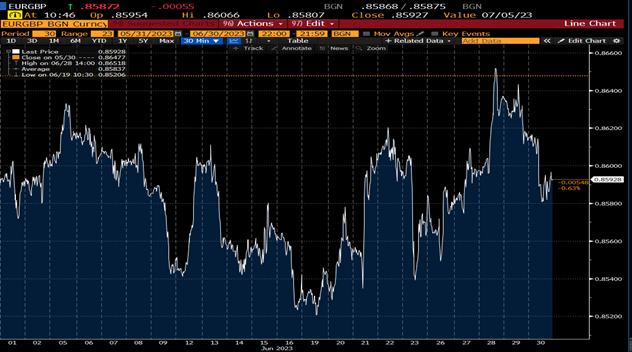

EUR/GBP

EURGBP has traded within the 0.8651-0.8520 range throughout the month of June, reaching its highest on the 28th of June after being sold-off for several weeks. This all came to play as the European Central Bank suggested that they will keep raising intertest rates further, with Christine Lagarde, ECB’s President, stating that more rate hikes are appropriate if they wish to make monetary policy sufficiently restrictive.

Source: Bloomberg

Core inflation in Europe remains a big concern for the central bank, and that seems to have supported the EUR bulls at the end of June but there could be also a downside for the euro in the upcoming month of July – A longer recession in Germany could affect the performance of the common currency, and if we look at GDP data, we see that Germany is in a technical recession after contracting GDP numbers consecutively for two quarters.

Source: Bloomberg

On the GBP front, investors are waiting for more policy guiding as inflation in the United Kingdom remain extremely off the desired target with no signs of a slowdown. The surprise of a 50-basis point by the BOE on the 22nd of June took sterling to new lows against the euro at 0.8520 but it was short-lived as we continue to trade in a tight range. Key factors to look out for will be any more insight into US Data and what’s next for the month of July as the EURGBP cross is likely to follow any moves on the mains EURUSD and GBPUSD.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.