Life Lessons and FX Advisory: Tyler Gibbons’ Story

What Losing My Son Taught Me About FX Advisory

The only constant in life is change.

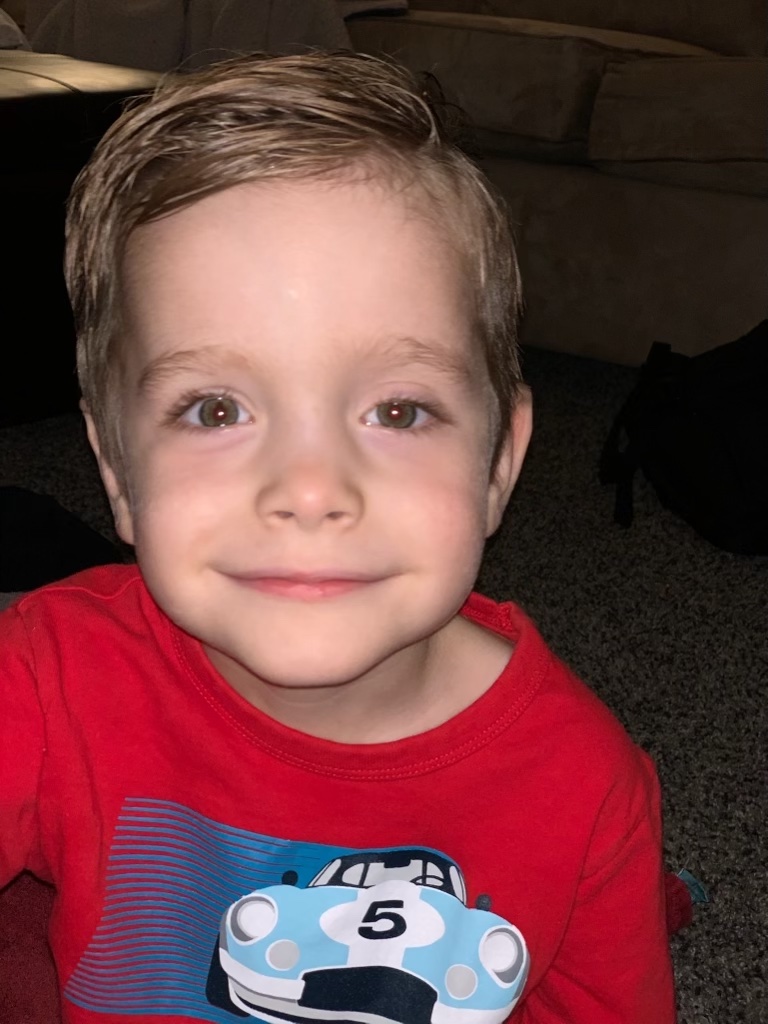

In 2016, my career managing FX Risk at GPS was hitting full stride when my son Reddik was born. He was a seemingly healthy, happy baby boy, and blessed my life in more ways than I can count. One lesson Reddik’s life taught me is about the importance of finding experts and advisors who will listen and, with diligence and care, find effective solutions.

One night before putting Reddik to bed, he had a big seizure. He was just five months old. We had no idea that night and that seizure would forever change our path. One seizure turned into multiple seizures which turned into clusters of seizures multiple times per day. One day Reddik was a happy, healthy baby boy with a bright future. Overnight, his health evaporated, and his future was unclear.

We set about to make sense of the unfamiliar words we were hearing— infantile spasms, epilepsy, titration, cortical dysplasia etc. It was a foreign world we never wanted to be a part of. Our initial doctors and therapists were supportive but, as we later discovered, weren’t equipped to identify and address Reddick’s needs. Years of failed medications, unclear diagnostics, harsh dieting, and countless seizures left us feeling hopeless and without direction. However, it wasn’t until a fateful turn of events stemming from a new career opportunity that put us on a path that changed everything!

I was asked to open a new region for GPS and our little family moved to the Boston area for my career, which meant we would be moving away from family and friends, but more importantly, our support system. At that point, Reddik’s seizures had robbed him and our entire family of any semblance of a normal life and we were at our wit’s end. However, after arriving in Boston, we witnessed miracle after miracle as Reddik’s new team of doctors, therapists, and medical staff were able to finally provide the answers and the help that Reddik and our family so desperately needed.

After years of of being in the dark, we finally received a firm diagnosis, and with that an understanding that, although Reddik’s condition was terminal, there was a lot we could do to improve his quality of life. His diagnosis led to surgery and to a set of new medications which greatly reduced his seizures. Perhaps the greatest blessing came in the form of an angel, Reddik’s physical therapist named Mindy.

Mindy was equipped with the right knowledge and tools to anticipate our family’s every need and to give Reddik the support we couldn’t. We saw our son come back to life as Reddik started smiling and laughing again, and we were blessed to begin to discover his beautiful personality. We were blessed with four more amazing years with Reddik before his passing that provided countless memories and a lifetime of lessons to reflect on.

Angel Mindy with our son Reddik

One of those lessons that has been pressing on my mind as of late is the importance of finding the right team advisors, equipped with the right tools and the bandwidth to help.

The Right Team

Finding the right team of specialists who could guide us was imperative and changed everything. We need to find specialists in our personal lives at home and in our careers to help us find the best possible solutions and outcomes we desire.

The cost associated with hiring and training professionals in this field can be prohibitive, especially for smaller companies with limited resources and budget constraints. Additionally, a shortage of skilled personnel poses a major obstacle for companies aiming to implement and maintain robust currency hedging strategies internally.

Individuals tasked with managing currency hedging programs can benefit greatly from advisors who have specific experience in specific currencies and instruments related to this unique subset of financial risk. Failure to acquire the right specialist can be catastrophic and hinder many organizations from focusing on their core competencies, eating up valuable time that could and should be better spent.

Tips for finding the right advisor:

- Find someone that you enjoy working with and trust to have your organization’s best interest in mind.

- Find someone willing to provide you with answers that may take your business away from themselves but are ultimately the right solutions to your needs.

- Find someone who can see past the short-term pain or vision and help you see the long-term vision or goals desired.

Unfortunately, finding a trusted advisor isn’t always easy, but as we discovered in our experience with Reddik, it was well worth the effort, and it made all the difference.

The Right Tools

In addition to having the right team of experts, having the right tools and platform can make all the difference throughout the journey to achieve the desired outcome. Reliable data forms the backbone of any effective hedging program. Inaccuracies in a company’s internal data, such as forecasted revenues, expenses, or errors within their ERP systems, can significantly impact the effectiveness of a company’s hedging program. Collecting this data is not a one-time task but a continuous endeavor that asks a lot from a company’s finance teams.

Find a platform with tools that are efficient, intuitive, automated, and have strong reporting capabilities that allow you to have greater visibility into your organization’s global FX exposure. Make sure you can review your data often and can react nimbly and adjust your positions to address any changes in market conditions.

Over the past decade, there has been a significant boom in software tools designed to assist finance teams in understanding their FX risk and visualizing their data. These tools can provide valuable insights and analytics, enabling finance teams to better grasp their position in the currency markets. But while these software solutions offer valuable data visualization and analysis capabilities, they often fall short of providing comprehensive guidance on the best strategies to manage currency hedging programs effectively; relying solely on software tools may not suffice.

Time, Efficiency, and Bandwidth

Most companies struggle to be efficient, but the right tools can provide improvement.

If running your company’s currency hedging program is 10% of your job responsibility, a worthy goal is for it to take no more than 10% of your time. Unfortunately, I often hear organizations say, “We don’t have the time,” or “We can’t afford to tackle our FX issues.” The reality is, you can’t afford not to find the time and tackle your FX issues!

Another significant challenge for companies is finding experienced specialists in-house to manage currency hedging programs effectively. Currency markets are complex and constantly evolving, requiring an understanding of financial instruments, market trends, and risk management strategies.

Market conditions can change rapidly, and what might have been an effective hedging strategy yesterday may no longer be suitable today. This underscores the importance of having a trusted advisor or specialist who can offer expert guidance and insights tailored to the specific needs and circumstances of a company. While software tools can provide data and analysis, the human element of experience and expertise remains indispensable in effectively navigating the complexities of currency hedging. While investing in software tools can be beneficial, companies must also recognize the value of having knowledgeable professionals who can interpret the data and recommend appropriate hedging strategies in response to changing market conditions.

Conclusion

In our journey with Reddik, at every turn it seemed like we found ourselves with more unknowns, risks, and side effects. Ironically, as I sit in board rooms or on Teams calls, I watch executives grapple with these same emotions as they try to implement hedging strategies for their companies. I can’t stress enough the importance of finding your own trusted advisers with the requisite expertise, tools, and bandwidth to provide solutions. Specialists, like Reddik’s Mindy, cared and helped us obtain not only the necessary equipment but also gave us confidence in the path forward.

As you embark on your own journey with FX or with life in general and ultimately face the inevitable reality of change, I hope you surround yourself with the right team and tools, as it will make all the difference.