FX Markets Update: November 2023

Subscribe to GPS’ Monthly Market Brief

ANALYSIS BY REGION

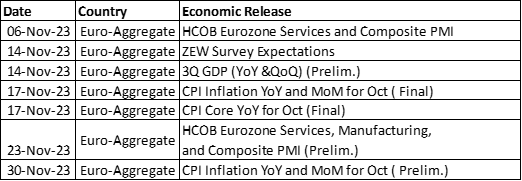

Euro-Area

- The European Central Bank left all three key policy rates unchanged at the October 26 meeting, leaving the deposit rate at 4%. The message after this meeting was clear, and no more hikes are expected. Various gauges show that underlying price pressures are decreasing as the economy shows significant cracks in activity due to the restrictive monetary policy in place.

- The euro-area economy has proven resilient despite all the rate hikes injected following the energy-linked inflation, but we don’t know how long this will be sustained. The economy is expected to stagnate in the upcoming months, with the Central Bank’s September forecasts pointing to an expansion of 0.1% in 4Q. The region contracted by 0.1% in 3Q23, which, given the tight borrowing regime and the significant drop in activity, is not too bad.

- The region’s headline inflation dropped sharply to 2.9% in October from the previous 4.3% in September, and the core reading fell to 4.2% from the previous 4.5%. The drop was sustained by the 6.2% energy-linked inflation from October 2022, falling out of the yearly comparison. Headline and Core inflation are estimated to keep decreasing until the end of the year and throughout 2024, even falling below the ECB’s 2% target.

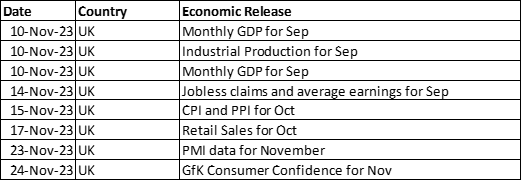

United Kingdom

• As widely expected the Bank of England voted 6-3 to keep interest rates unchanged at the 2 November MPC meeting. Officials held the benchmark at 5.25% for the second consecutive meeting, prompting many analysts to believe that the next move in interest rates will be down – however rates are unlikely to be cut until the second half of 2024.

• Governor Andrew Bailey voiced caution, insisting that it is “much too early to be thinking about rate cuts.” Bailey continues with the ‘higher for longer’ rhetoric saying that restrictive policy is likely needed for an extended period as the committee continues to battle stubborn inflation.

• Inflation in the UK remains significantly above the central bank’s 2% target, with September’s CPI report coming in at 6.7% from a year earlier, the same as the previous month, but above predictions of 6.6%. The key data release for the UK in the coming weeks will be October’s CPI release on 15 November. A significant reduction is expected, following lower energy prices but the BoE remains vigilant with the committee vowing to hike again should inflation remain sticky.

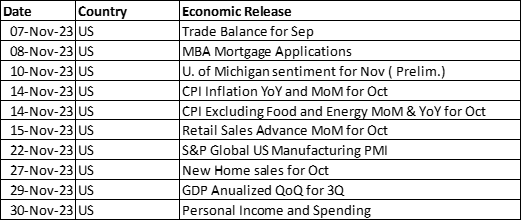

United States

- The Federal Reserve left their funds rate in the 5.25%-5.50% range at the FOMC November 1 meeting, and both the Fed’s Chair Jerome Powell’s speech and the FOMC policy statement had a dovish tone. The committee seemed to have not taken many signals from the strong quarter data or the blowout September jobs report but rather from the medium/long-term downward view on inflation and labour market data. Fed Chair Jerome Powell stated that the September dot plot could already be outdated, meaning that further rate hikes may not be necessary.

- October’s jobs report came in a day after the FOMC meeting, and it could not scream any more dovish. A strong slowdown across Non-Farm Payroll, the ADP employment report, and the uptick in the unemployment rate looked encouraging to help the Fed bring inflation back to its 2% target. ISM Surveys point to a growth slowdown, with ISM Manufacturing dropping to 46.7 due to a fall in new orders.

- The Fed, although dovish for now, remains “alert” – the current “wait and see” strategy is part of the committee not having a clear picture of the disinflation and growth trend, and are worried that they may have to hike interest rates again.

CURRENCY PAIRS: What is next?

EUR/USD

- Following October, it feels like the market shifted its sentiment on the pair drastically. We broke the bearish channel we had been trading since July, and we did so aggressively. We are currently trading at 1.0753, with big support at 1.0805, where the 100d and 200d MA meet (see the below graph).

- This move can be the start of a greenback retracement, where we may start to see some more euro bulls coming into play. Both the Fed and ECB seem done with their tightening campaigns and the focus now shifts more to any geopolitical tensions coming out of the Middle East (should trigger USD buying), the US Debt sustainability (which can trigger Euro buying), and any Euro-area data picking up.

- First Resistance sits at 1.0750 followed by Key Resistance at 1.0805.

- First Support sits at 1.0660(pre-NFPs resistance) followed by Key Support at 1.0520.

Source: Bloomberg

Source: Bloomberg

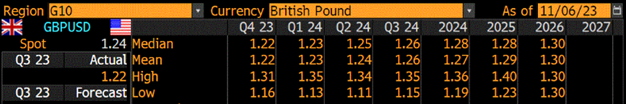

GBP/USD

- The month of October saw GBPUSD trading broadly within a 1.21-1.23 trading range, with a downside bias as highlighted below. Currency markets took the pause in interest rates from the BoE and ECB in their stride, however, investors turned bearish on the greenback following the dovish Fed meeting and softer than expected Non-farm Payrolls.

- GBPUSD followed EURUSD higher, breaching resistance and pushing cable out of its down-channel driven by lower US yields as worry shifts to US debt sustainability.

- The market has been short sterling for some time, so it is not surprising that recent moves have been dramatic, with the post-NFP rally opening a potential run at the 200-day MA at 1.2435.

- Old resistance now acts as fresh support with 1.2335 sitting as initial support ahead of the recent low of 1.2070.

Source: Bloomberg

Source: Bloomberg

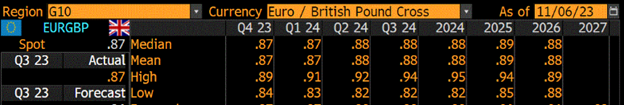

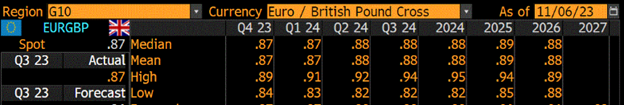

EUR/GBP

- The cross continues to trade below 0.8691 (200d MA (Green)), which was seen as a bearish signal. We have retraced back to the range we have been in since June (0.85-0.87) and the market seems positioned to trade lower, following the break of the 200d MA.

- In both regions, growth is weak, and the pair is likely to gain direction on any growth differentials and marginal differences in monetary policy between the ECB and BOE. From what we saw last week, the BOE looked slightly more hawkish than the ECB, where members who want further hikes are marginally higher than the ECB policymakers.

- First resistance sits at 0.8690 (200d MA), followed by key resistance near 0.88.

- First Support sits near 0.8610, followed by key support near 0.8500.

Source: Bloomberg

Source: Bloomberg

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.