Q1 2023 Market Report : Should your Hedging Strategy Change?

It is good risk management to assess a hedging strategy and adapt where necessary as market conditions change. There has been significant change in the first quarter of 2023, so it is a good time to pause and analyze the factors involved in hedging. In this article, GPS will look at EUR, GBP, AUD and CAD, each against the USD.

SUMMARY OF CHANGES

- Volatility – Moved from high to neutral

- Spot – has been mixed for each pair

- Forward points – large movements but mostly in the medium term

- Risk reversal – USD calls are still over but are less in demand

VOLATILITY

Implied or traded volatility has fallen since the start of 2023. Traded volatility has moved from elevated levels back to just above the average over the last 5 years. Strategies which are long volatility (vanillas / participating forwards / tracker forwards) are starting to price more favorably. The pendulum is starting to swing from outperformance strategies to structures which give the buyer more control. This can make a difference through the risk to reward profiles while pricing.

3-month implied (market traded) volatility of EURUSD (blue), GBPUSD (red), AUDUSD (white) and USDCAD (yellow) over the past 5 years.

SPOT

The fate of the spot market has been mixed so far this year with EUR, GBP and CAD gaining ground against the USD, while the AUD has ended up losing ground. Data has been closely watched to gauge the impact of monetary policymakers. Speculation over the health of the banking system has also caused significant movement.

It should be noted the charts are in percentage rather than nominal terms. The AUDUSD currency pair has had the most movement and the USDCAD has been the most stable. It should not be a surprise that AUDUSD has the highest implied volatility (10.8%) and USD the lowest (6.3%).

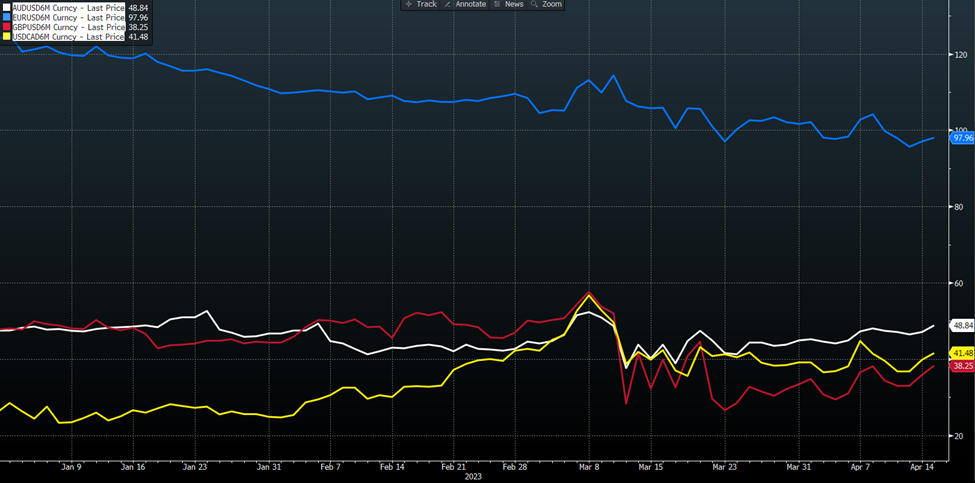

Forward points since the beginning of 2023 of EURUSD (blue), GBPUSD (red), AUDUSD (white) and CADUSD (yellow).

FORWARD POINTS

The movement of yield curves has been extreme over the last year. The US curve has led the way with the highest yield, but rates fell in the wake of Silicon Valley and Signature Banks collapses. These changes were most seen in the medium part of the curve here (1-3 years). The chart below shows the 6-month forward points of the currency pairs. Significant changes in forward points can create better hedging opportunities for the corporate treasurer. Although we have seen good movement during 2023 the expectation in the front of the curve where most hedging occurs has not moved significantly.

Forward points since the beginning of 2023 of EURUSD (blue), GBPUSD (red), AUDUSD (white) and CADUSD (yellow).

RISK REVERSAL

The risk reversal measures market sentiment by measuring the price of call options vs. puts options. In all cases in the chart below the USD calls are more expensive than the puts. For example, the 3-month EUR Puts / USD calls cost 0.4% more than the EUR calls / USD puts. Both the AUDUSD and the GBPUSD have the most pronounced risk reversals due to the way the spot trades – spot typically falls at a much faster pace than it rises.

This measure is significant as it alters the payoff profiles and pricing of structured products. In practical terms this means that barriers levels can be pushed further ways or protection brought closer by taking advantage of this. These levels have softened during 2023, making it more attractive for US firms exporting their goods.

3-month 25 delta risk reversal since the beginning of 2023 for EURUSD (blue), GBPUSD (red), AUDUSD (white) and CADUSD (yellow). The negative numbers translate into USD calls being at a premium.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.