Risk of USD/JPY Weakness Seen in the Options Markets

SUMMARY

The next Bank of Japan meeting is scheduled for 16 June which will be the second meeting with new governor Ueda in charge. There is a possibility that the Ueda will make changes to the BOJ yield curve controls. The market is starting to position for the risk of a downward move in USD via options.

ANALYSIS

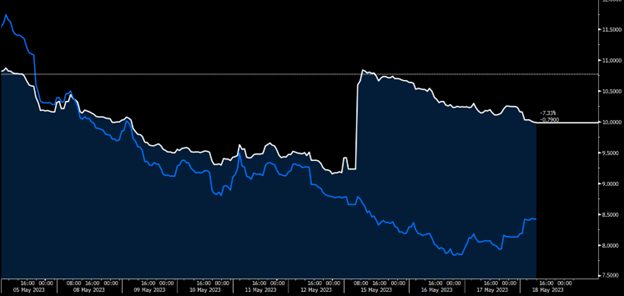

Firstly, when the 1-month volatilities rolled to a date which included the announcement, we can see the 1-month traded volatility jumped about 1.6% (from 9.2% to 10.8%). This is in a market that was otherwise trending lower.

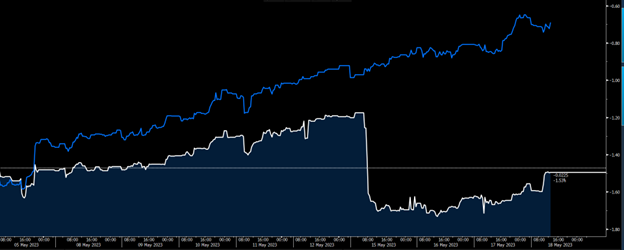

Secondly, we have seen on the same date the bias on the JPY calls (USD puts) increased from 1.2% to 1.7%.

The chart above shows the USD/JPY 1-month volatility in white and as a reference the 2-week USD/JPY volatility in blue.

The chart below shows the USD/JPY 1-month risk reversal in white and as a reference the 2-week USD/JPY in blue. The negative number shows that 25 delta JPY calls (USD puts) trade above the equivalent puts.

What is this big movement in the USD/JPY option volatilities telling us?

Firstly, is that there is now some movement expected from the Bank of Japan. This is something that we have seen very little of over the years. Secondly, we are expecting to see more volatility in the USD/JPY.

Contact us to learn how our tailored financial solutions, competitive exchange rates and leading payments platform can help you.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.