Comprehensive Guide to FX Hedging for Corporate Risk Management

WHAT IS FX HEDGING?

FX hedging, also known as foreign exchange hedging, is a strategy used by companies and investors to mitigate or reduce the risk of loss due to fluctuations in foreign exchange rates. FX hedging involves using financial instruments or strategies to offset the risk of currency movements that could negatively impact a company’s profits or investments.

WHEN IS FX HEDGING NEEDED?

The are several reasons why a company may need FX hedging:

Protect Profits

Protect Profits

FX hedging can help protect a company’s profits from the negative impact of currency fluctuations. By hedging against adverse currency movements, a company can minimize the risk of losses due to changes in exchange rates.

Manage Cash Flow

Manage Cash Flow

FX hedging can also help companies manage their cash flow by providing greater certainty around future cash flows. This can help companies plan and budget more effectively.

Reduce Risk

Reduce Risk

By hedging their FX risk, companies can reduce their exposure to currency fluctuations and minimize the risk of losses due to unexpected changes in exchange rates.

Competitive Advantage

Competitive Advantage

Companies that effectively manage their FX risk through hedging may have a competitive advantage over their peers, as they are better able to manage their costs and maintain profitability.

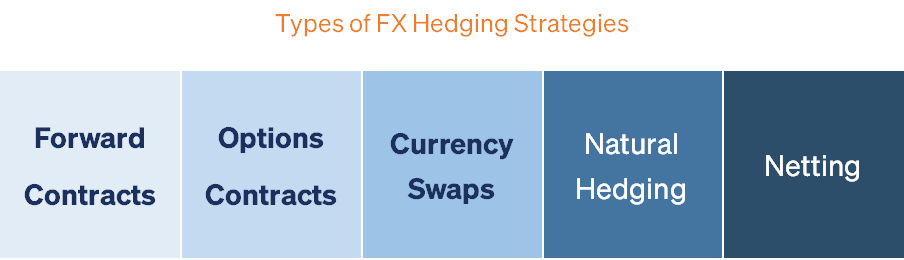

FX HEDGING STRATEGIES

Companies have a variety of hedging alternatives at their disposal to effectively manage the risks derived from dealing in multiple currencies based on the type of traded currencies, the nature of the business transactions, and risk appetite.

Forward Contracts

A forward contract is an agreement to exchange a specific amount of currency at a predetermined exchange rate on a future date. Forward contracts allow companies to lock in a specific exchange rate and reduce their exposure to fluctuations in currency rates.

Options contracts

An options contract gives the holder the right, but not the obligation, to exchange a specific amount of currency at a predetermined exchange rate on a future date. Options contracts provide flexibility in managing currency risk, as companies can choose whether or not to exercise the option.

Currency Swaps

A currency swap is an agreement between two parties to exchange a set amount of currency at an agreed-upon exchange rate, with the agreement to reverse the transaction at a future date. Currency swaps can help companies manage their currency risk by allowing them to exchange currencies without incurring transaction costs.

Natural Hedging

Natural hedging involves matching revenues and expenses in the same currency. This can help reduce a company’s exposure to currency risk as fluctuations in exchange rates will have less of an impact on the company’s profitability.

Netting

Netting involves offsetting payables and receivables denominated in the same currency. This can help reduce a company’s currency risk by reducing the amount of currency that needs to be exchanged.

WHAT TO LOOK FOR IN AN FX HEDGING PROVIDER?

Selecting the best FX hedging provider requires careful consideration of several factors. By taking the time to research and compare providers, you can find a provider that meets your needs and provides the support and resources you need to manage your currency risk effectively.

Experience and Expertise

Look for a hedging provider with a track record of success in managing currency risk. Consider their experience in your industry, their understanding of your business needs, and their expertise in managing FX risk.

Customization

Choose a provider that offers customized hedging solutions tailored to your specific needs. A good provider will work with you to develop a hedging strategy that matches your risk profile and business goals.

Transparency

Look for a provider that is transparent in their hedging practices. This includes clear communication about their hedging strategies, fees, and any potential risks associated with their services.

Risk Management Tools

Choose a provider that offers a range of risk management tools and resources, such as real-time market data, analytics, and reporting tools. These tools can help you monitor your hedging strategies and adjust them as needed to reduce your exposure to currency risk.

Customer Support:

Look for a provider that offers good customer support. This includes prompt and helpful responses to inquiries and a range of support options, such as email, phone, and live chat.

Regulatory compliance

Choose a provider that complies with regulatory requirements in your jurisdiction. This includes compliance with regulations related to customer protection, data privacy, and financial reporting.

Reputation

Look for a provider with a good reputation in the industry. Consider their track record, customer reviews, and any industry awards or recognition they may have received.