All Eyes on the Peso: Mexico Overtakes China to be the Largest Exporter to the US

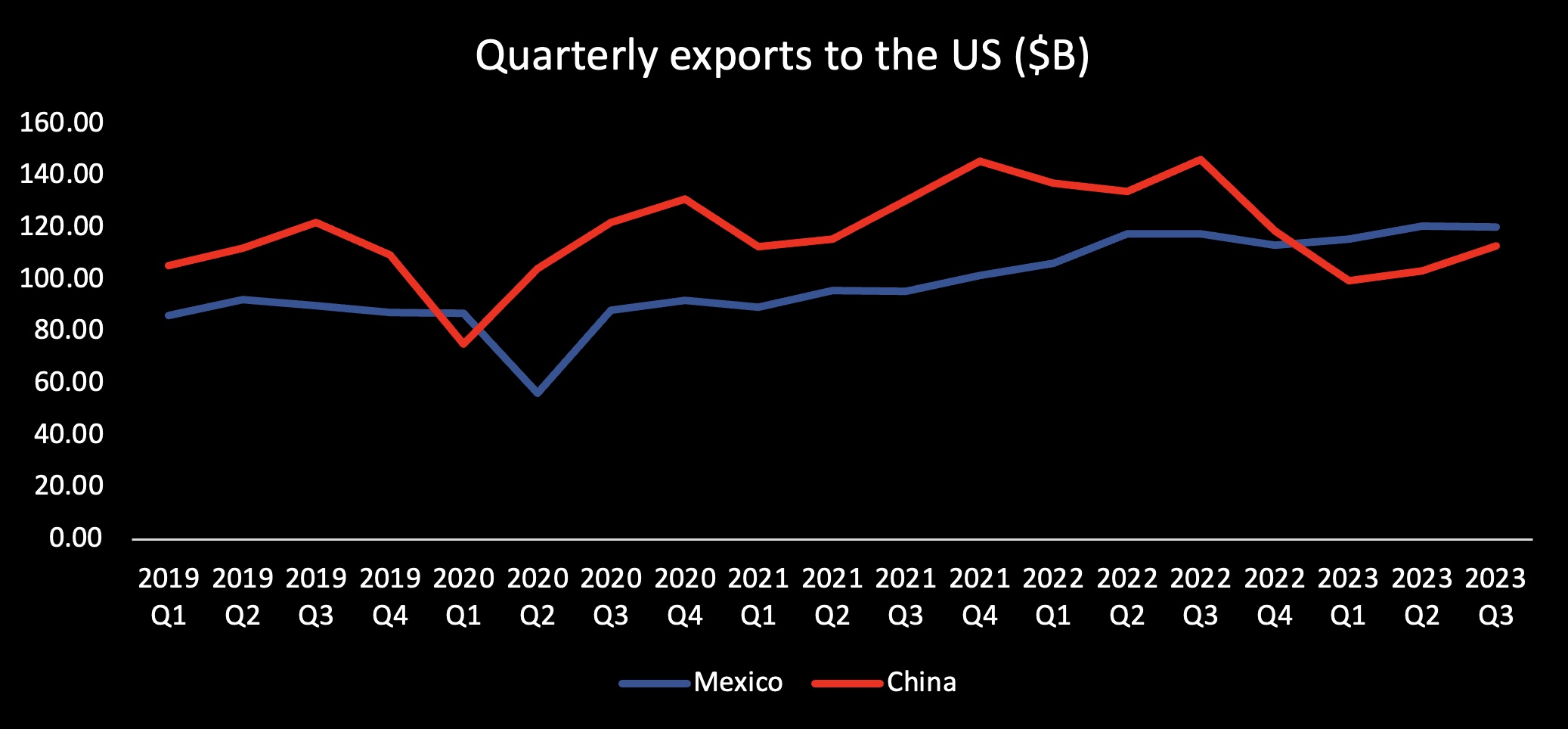

Recent data from the International Monetary Fund (IMF) shows Mexico as the new top exporter of goods to the US, dethroning China as the long-time leader of over 20 years. China had a significant decrease in exports to the US of 20% from 2022. The largest export products consist of cars, trucks, computers, parts, machinery, equipment, computers, and crude oil.

This significant milestone can be attributed to many factors such as the buoyant US economy, but also Chinese supply-chain bottlenecks, escalating trade tensions, rising labor costs in China, and logistical challenges have prompted American companies to reassess their supply chains and explore alternative sourcing options closer to home.

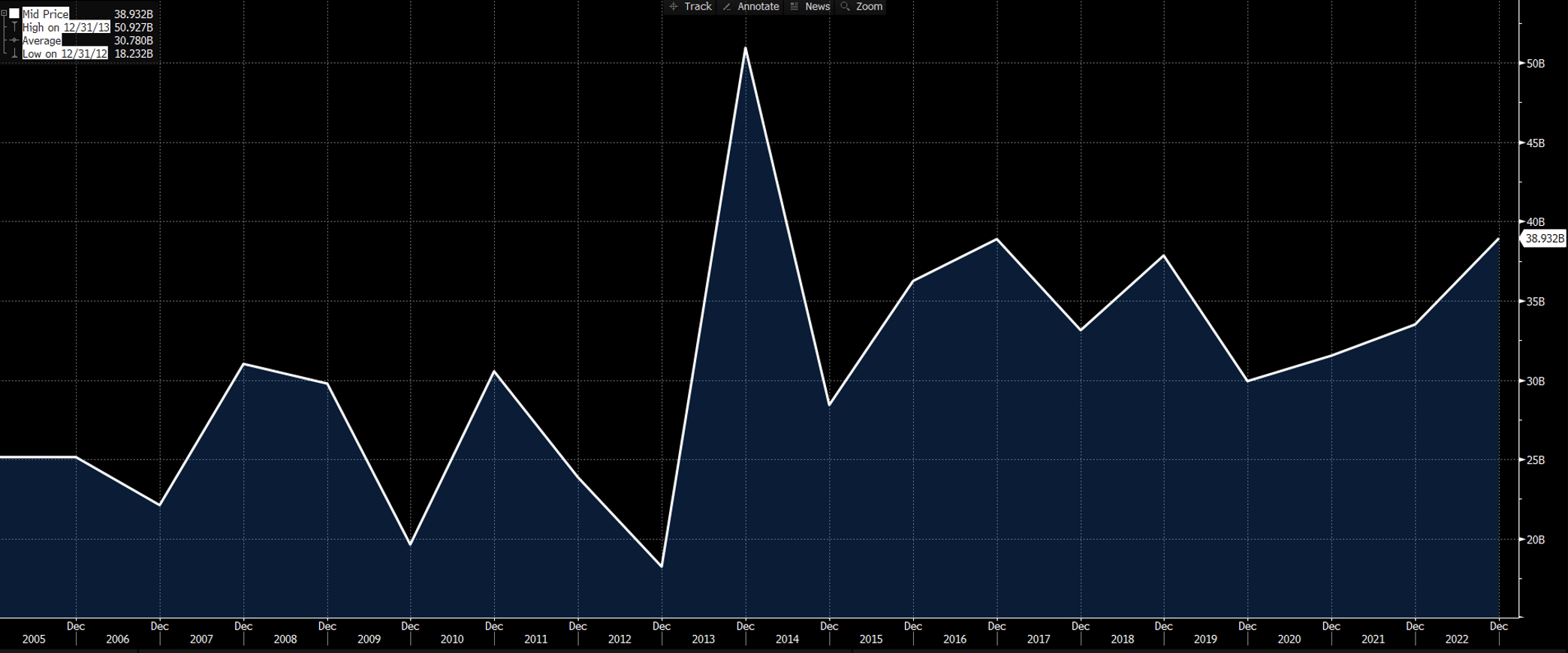

Enter Mexico, whose strategic geographical proximity – a process referred to as Nearshoring has occurred where multinational companies have relocated their manufacturing plants from China to Mexico. The proximity can enable potential savings in the forms of transportation, and labor costs, as well as give firms more control. Direct foreign investment has been a boost for the peso.

Other contributors to Mexico’s success are a well-established infrastructure and a growing skilled labor force have made it an attractive destination for businesses seeking to diversify their supply chains and mitigate risks associated with long-distance trade.

Quarterly exports to the US using IMF data

Source Bloomberg: Quarterly foreign investment in Mexico continues to grow.

SPOTLIGHT ON MEXICO = SPOTLIGHT ON THE MEXICAN PESO

So, what does all this mean for the Mexican peso (USD/MXN)? The peso is currently trading at 17.12, down from 18.38 one year ago and 20.49 two years ago. We will delve into the drivers of the currency pair and discuss what will be important for the year ahead.

Source Bloomberg: USD/MXN over the last five years – After a sharp depreciation in 2020, the MXN has strengthened each year since 2020.

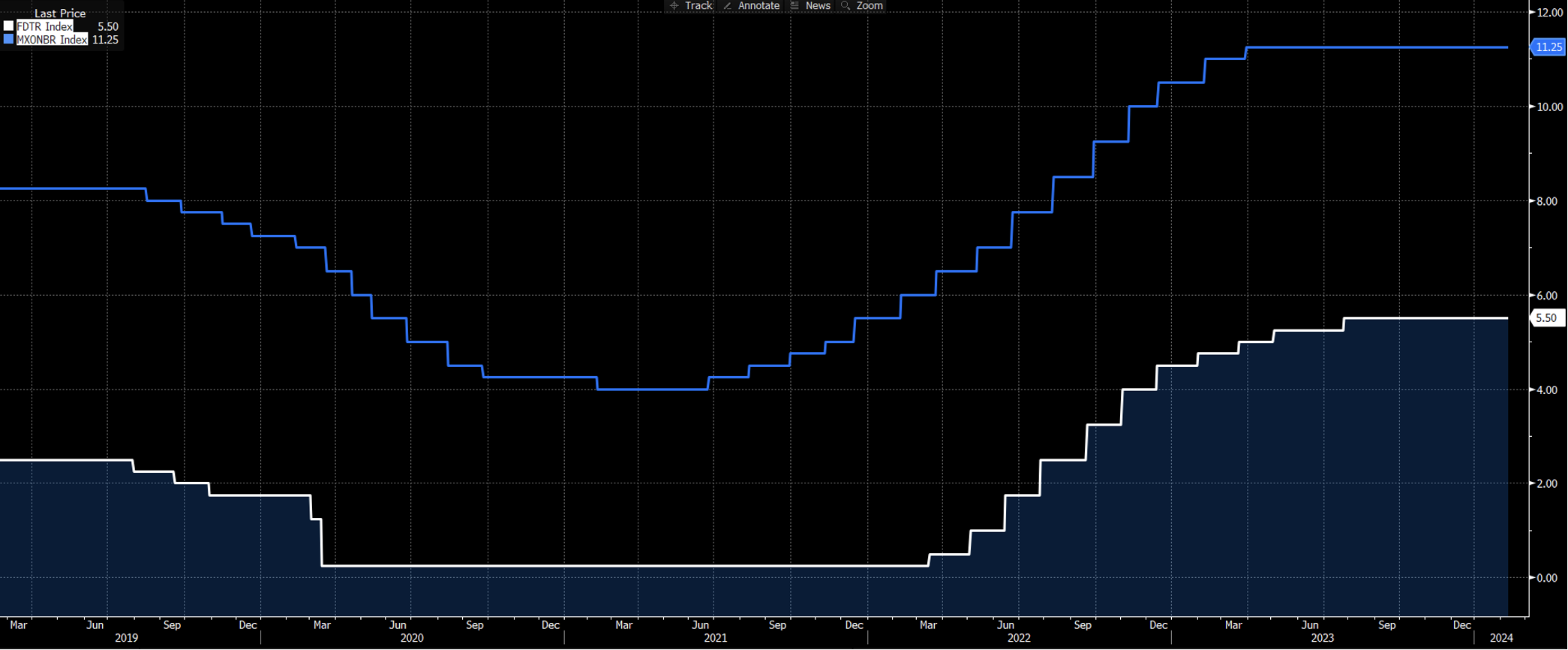

MONETARY POLICY

The largest driver of foreign exchange rates is interest rates. The fact that Mexico has maintained a consistently higher yield has greatly benefitted the MXN. Both the US and Mexico have battled with inflation over the last two years, which has had a significant impact on each country’s monetary policy. The rate differential has certainly been providing some support for the MXN with a 5.75% yield differential to the Fed. The two yields over the past five years have experienced a steady differential.

Source Bloomberg: Banxico official overnight rate (blue) vs FOMC offer rate (white)

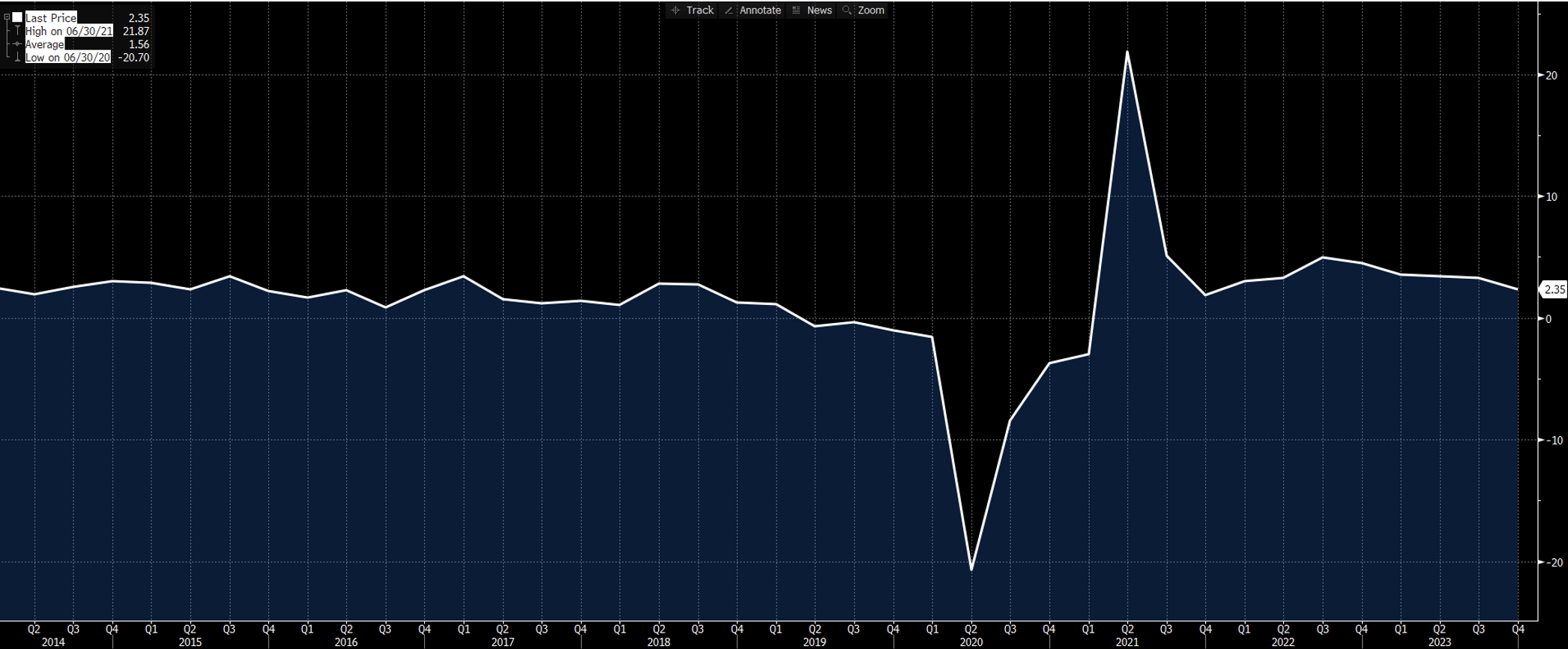

ECONOMICS

Both economies have been subject to inflationary pressures. This is something Mexico has had to deal with since before the pandemic. With GDP as an indicator of the strength of an economy, it is GDP that has helped the MXN appreciate to the level it has. After a sharp fall in 2020, Mexican GDP has recovered and continues to grow.

Source Bloomberg: Yoy CPI in Mexico (white) vs US (blue)

Source Bloomberg: GDP of Mexico (inflation adjusted)

OTHER FACTORS

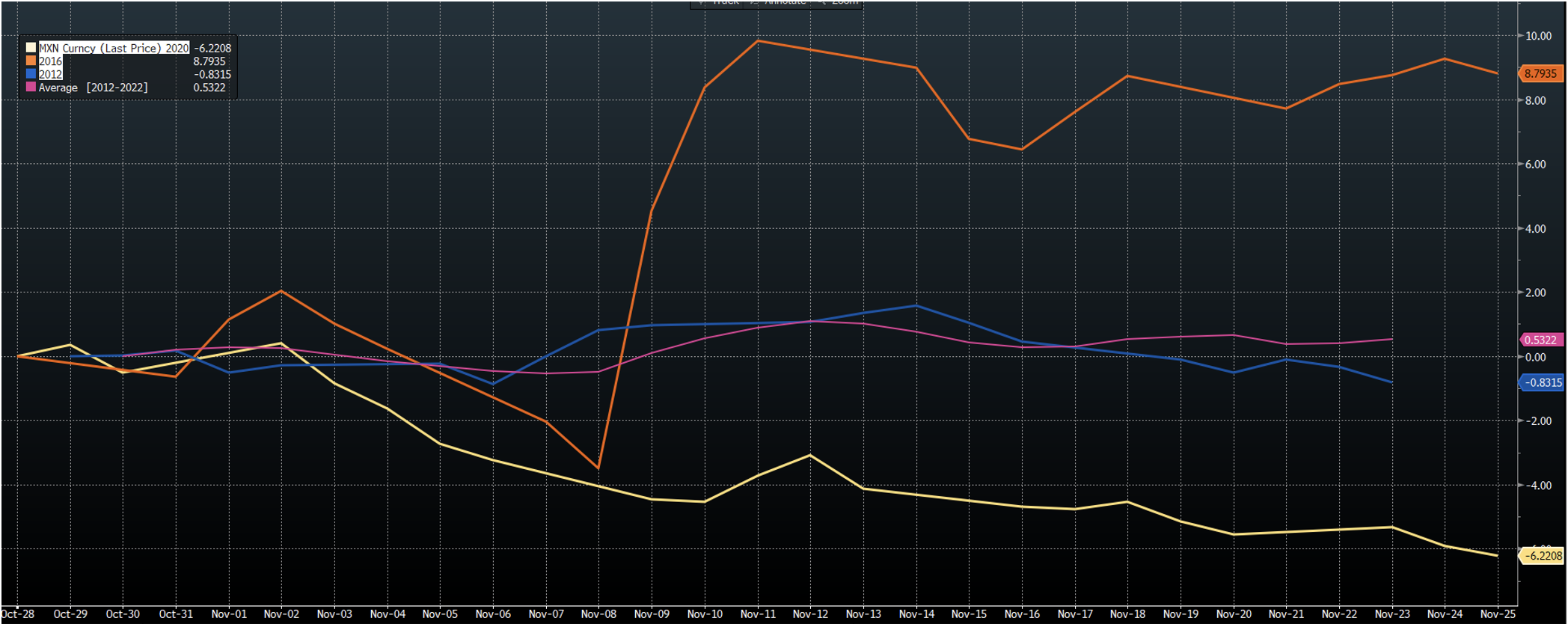

2024 is the year of elections across the globe, with the US presidential election at the forefront with the potential to add significant volatility to markets. There will also be elections in Mexico this year. GPS research shows that there has been a 14.3% swing in the USD/MXN between the two leading US candidates and this could provide hedging opportunities and risks.

Find the GPS article discussing the outlook for currencies and the upcoming election’s impact here: FX Risk and Currency Markets in a US Election Year

Source Bloomberg: USD/MXN percentage movement during election years 2020 (yellow), 2016 (orange) and 2012 (blue)

CONCLUSION: FORECASTS AND HEDGING

Mexico’s rise as a leading exporter to the United States signals a significant shift in North American trade dynamics, with implications for global supply chains. By leveraging its geographical proximity, skilled workforce, and favorable trade agreements, Mexico has emerged as a compelling alternative to China for American businesses seeking reliable and efficient sourcing solutions. As both countries navigate the evolving landscape of international trade, the stage is set for Mexico to solidify its position as a key player in the global economy.

The median forecast for the USD/MXN is 17.70 according to contributors to Bloomberg. This represents a 3.5% depreciation in the currency. It should be noted that the same analysts’ forecasting did not manage to predict the direction over the last 2 years. The strength of the currency remains hinged on the rate spread which makes peso-denominated assets appealing coupled with the mentioned trade and investment flows.

WHAT TO DO FOR YOUR COMPANY

Hedging MXN purchases can be more effective with the use of forward contracts. Because of the interest differential, which is built into the pricing, it allows exchange rates to be above the spot levels. Long-term hedging can also be done very effectively with options and pricing looks appealing with volatility close to 5-year lows.

If your company isn’t leveraging the current emerging market (EM) conditions to reduce FX risk and reap the rewards of doing business in those EM countries like Mexico, see our recent article for further insight and to learn what opportunities are available to do so: Could You Be Managing Your EM FX Risk Better?

It is wise to take some time to evaluate your company’s current FX strategy regularly. If this is something you haven’t evaluated for some time or your company is involved with Mexico, let one of GPS’ FX advisors analyze your processes and exposures to put you in the best position possible to operate internationally.

Contact a GPS FX currency advisor directly here: Book a call with GPS

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.