April FX Market Insights: Key Trends and Analysis

FINANCIAL MARKET ANALYSIS BY REGION

Euro-area

- Markets continue to believe that the ECB will deliver its first interest cut at the 6th June policy meeting. Officials have pushed back against the idea that they plan to keep reductions inline with the Federal Reserve, continuing to suggest that economic data will dictate the timing and size of cuts.

- Inflation remains on the correct path; however, the central bank remains wary of the strength of the euro area’s labour market, with wage growth a potential roadblock to early rate cuts. Recent positive date out of Germany, particularly in the manufacturing sector indicates that the worst may be over for the bloc’s largest economy, notably dampening recession concerns.

- Markets will pay close attention to the 11th April policy meeting, in particular President Christine Lagarde’s press conference with investors seeking further clues on the timing of both the first and second cut from the ECB.

| Date | Country | Economic Release/Event |

| 11- April-24 | Euro-Aggregate | ECB Main Refinancing Rate |

| 11-April-24 | Euro-Aggregate | ECB Marginal Lending Facility |

| 11-April-24 | Euro-Aggregate | ECB Deposit Facility Rate |

| 17-April-24 | Euro-Aggregate | CPI YoY |

| 17-April-24 | Euro-Aggregate | CPI MoM |

| 17-April-24 | Euro-Aggregate | CPI Core YoY |

| 23-April-24 | Euro-Aggregate | HCOB Eurozone Manufacturing PMI |

| 23-April-24 | Euro-Aggregate | HCOB Eurozone Services PMI |

| 23-April-24 | Euro-Aggregate | HCOB Eurozone Composite PMI |

| 26-April-24 | Euro-Aggregate | M3 Money Supply YoY |

United Kingdom

- As widely expected, the BoE kept interest rates on hold at the March MPC meeting, electing to pause the benchmark rate at 5.25% for the fifth consecutive meeting. However, two of the committee’s most hawkish members dropped their call for a rate hike, with none of the nine members voting for a hike for the first time since September 2021. The timing of the first rate cut from the BoE remains a hot topic, with some now suggesting that the UK may even be able to signal a reduction before the Federal Reserve.

- Inflation in the UK took a further step in the right direction, with February’s CPI rising 3.4%, significantly below previous months 4% print and an improvement on expectations of 3.5%. Lower energy bills are expected to push inflation closer to the BoE target of 2%, giving comfort to officials on the MPC to signal a rate cut in the coming months. The Swiss National Bank became the first major central bank to drop its benchmark rate leading to a repricing by markets, which currently pricing a 63% chance of a rate cut from the BoE in June.

- Markets and the BoE however, remain nervous of inflation, and both will be anxiously watching the latest CPI report due out on 17 April, seeking confirmation that inflation continues to fall. The 9th May BoE policy meeting appears too soon to deliver a reduction with MPC members more likely to want to review further data before delivering a cut.

| Date | Country | Economic Release |

| 12-April-24 | UK | GDP QoQ |

| 12-April-24 | UK | GDP YoY |

| 12-April-24 | UK | Industrial Production MoM |

| 12-April-24 | UK | Manufacturing Production MoM |

| 16-April-24 | UK | Jobless Claims Change |

| 16-April-24 | UK | ILO Unemployment Rate 3Mths |

| 16-April-24 | UK | Claimant Count Rate |

| 17-April-24 | UK | CPI YoY |

| 17-April-24 | UK | CPI MoM |

| 17-April-24 | UK | CPI Core YoY |

| 19-April-24 | UK | Retail Sales Inc Auto Fuel MoM |

| 19-April-24 | UK | Retail Sales Inc Auto Fuel YoY |

| 23-April-24 | UK | S&P Global UK Manufacturing PMI |

United States

- The Federal Reserve has six remaining policy meetings in 2024, and markets are currently pricing three cuts of 25 basis points throughout the year. There has been a significant shift in the dot plot and outlook for US rates since the turn of the year when the market was suggesting up to 7 cuts of this size.

- Non-farm Payrolls for March came in above expectations at 303k and were the largest monthly change since last May, suggesting the labour market remains solid. The March inflation report will likely be closely scrutinised as it comes after two ‘hot’ prints in 2024. In chairman Powell’s view, the disinflation journey remains bumpy and is limiting the number of cuts that the FOMC will be able to deliver.

- The recent fall in core personal consumption expenditure, the Fed’s preferred gauge of underlying inflation suggests that a soft landing for the economy remain in focus. The Fed remains data dependant, although markets will also be searching the minutes of the Fed’s last policy meeting for the rationale behind the recent shift in the dot plot.

| Date | Country | Economic Release |

| 05-April-24 | US | Change in Nonfarm Payrolls |

| 10-April-24 | US | CPI MoM |

| 10-April-24 | US | CPI YoY |

| 10-April-24 | US | MBA Mortgage Applications |

| 10-April-24 | US | FOMC Meeting Minutes |

| 11-April-24 | US | Initial Jobless Claims |

| 12-April-24 | US | U. of Mich. Sentiment |

| 15-April-24 | US | Retail Sales |

| 16-April-24 | US | Industrial Production |

| 18-April-24 | US | Initial Jobless Claims |

| 23-April-24 | US | Manufacturing, Services PMI |

| 25-April-24 | US | GDP |

| 25-April-24 | US | GDP |

| 26-April-24 | US | PCE Deflator |

CURRENCY PAIRS ANALYSIS

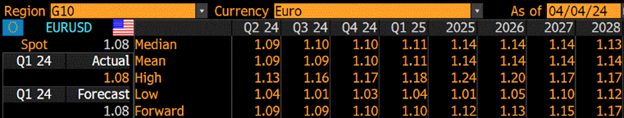

EUR/USD

- Another month with EURUSD in a tight well defined trading range. The single currency continues to be influenced by central bank policy, with the pair consolidating as traders seek direction ahead of the first cut from both the Fed and ECB. Markets appear content to allow the single currency to weaken against the greenback should the ECB cut more than the Fed.

- First support: 1.0720, key support at 1.0650

- First Resistance: 1.0920, key resistance at 1.0920

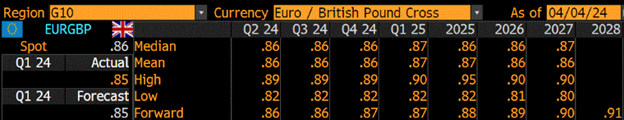

EUR/GBP

- EURGBP continues to trade broadly within a 0.85 to 0.86 range. The pivotal level remains at 0.8550 with the pair treading water as option volatility remains at historically low levels. With the BoE currently expected to be some time behind the ECB with its first interest rate cut, the pound remains support suggesting another test of the bottom of the range.

- First support: 0.8550, key support at 0.8500

- First Resistance: 0.8600, key resistance at 0.8700

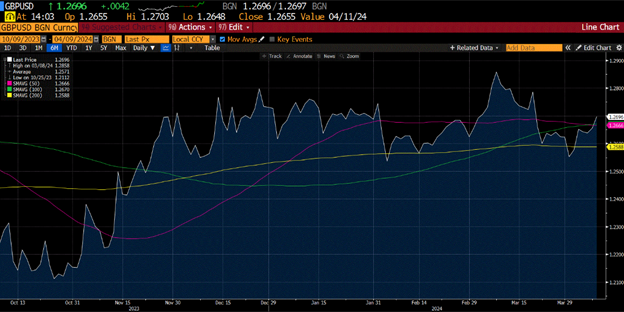

GBP/USD

- The month of March has been reasonably volatile for GBPUSD, with cable reacting to the ever-changing outlook for interest rates in both the US and UK. The pound made gains against the greenback towards the end of March, trading briefly through 1.28 as US treasury yields moved higher.

- The rally in cable was promptly reversed within days of reaching 1.28 as markets started to believe that the BoE may deliver more rate cuts in 2024 than the Fed.

- First Support: 1.2635; Key Support: 1.2500

- First Resistance: 1.2700; Key Resistance: 1.2800

For an analysis of your exposures and currencies mentioned in this FX Markets Update, schedule a call with a GPS FX advisor at www.GPSFX.com/book-a-call.

GPS Capital Markets provides corporate foreign exchange services to help companies manage foreign currency risk and execute foreign currency transactions.

Clients across the world trust GPS to minimize their FX risk and grow their international business by combining competitive exchange rates and our award-winning FXpert® platform with a host of tailored international financial solutions, including Intercompany Netting, Hedge Accounting, Balance Sheet Hedging, cross border payments, Data Analytics, and Cash Flow Hedging. For more information, book a call with one of our expert advisors.

This document is for information purposes only and does not constitute any recommendation or solicitation to any person to enter into any transaction or adopt any trading strategy, nor does it constitute any prediction of likely future movements in exchange rates or prices or any representation that any such future movements will not exceed those shown on any illustration. All exchange rates and figures appearing are for illustrative purposes only. You are advised to make your own independent judgment with respect to any matter contained herein.